Why do people like making planned gifts?

Planned gifts (most commonly a donation made in your will or trust) cost nothing today and allow you to make an incredible impact, which is why so many people choose to make them.

There are some other exciting but less common gifts — scroll down to learn more!

Popular gifts for the future

See what types of gifts many people choose to make. Many people make these to honor a loved one, to show what’s important in their life.

Gifts in a will or trust

Donations in your will or trust are (by far) the most popular type of planned gift. Learn more, or get help starting your will or trust – for free!

Beneficiary designations

Gifting assets not covered by your will — like 401(k) or IRA accounts — may help your heirs avoid unwanted taxes, even if you’re below the estate tax threshold.

Popular gifts for today

Many people love these donation options because they fit with their personal circumstances and financial goals.

Donor Advised Funds

Easily recommend grants to Pi Kappa Phi Foundation for tax-efficient giving.

Stocks and securities

Many people love donating stock or mutual funds because it may help them avoid paying capital gains taxes.

Qualified Charitable Distributions

Use your IRA to make tax-free gifts that benefit you and our mission.

Gifts that pay you back

Give assets while providing yourself or others with income for a period of time or distributions at a later date.

Please let us know if you’ve already included us in your estate plans!

Letting us know is incredibly helpful to our team and helps to make sure your gift is used the way you want it to be.

Make your mark with Pi Kappa Phi.

Since 1904, Pi Kappa Phi has prepared generations of young men to lead in their chapters, campuses, and communities. Their impact is the legacy of our Founders: a story of exceptional leadership which has bettered the world around us. Through a planned gift, you can leave a legacy that will advance the story our Founders began. Planned gifts allow you to make a lasting impact on Pi Kappa Phi.

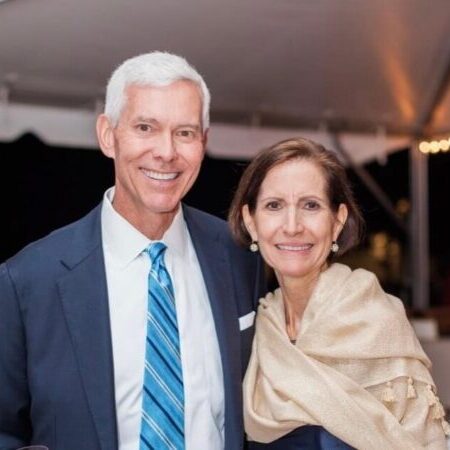

Stuart and Katie Hicks’ story

For a simple reason, Pi Kappa Phi Foundation is an identified beneficiary in my estate plans: I have been the true beneficiary for more than 47 years of membership and affiliation in Pi Kappa Phi and continue to be.

Read moreFrequently Asked Questions

The most common type of planned gift are through written estate plans. These gifts allow you to designate Pi Kappa Phi as a beneficiary of a gift in your will or trust. This is the most common type of planned gift, and it refers to any donation from your will or trust. You are able to make a planned gift to the Foundation through your will or trust simply by naming us as a beneficiary just as you would a loved one.

Gifts can be specified as:

- a specific dollar amount of money.

- a specified number of shares of stocks, bonds or mutual funds.

- a percentage of the value of your estate.

- specific items of value, such as a piece of property, a parcel of land, a vehicle, artwork, and more. (If you designate a gift in this way, please let us know before you finalize your plans to make it easier for the executor of your will and for the Foundation.)

- the “residue” in your estate; that is, the Pi Kappa Phi Foundation receives what remains after your other named priorities and loved ones have been (taken care of/attended to/accounted for) per your wishes.

- a “contingent beneficiary.” For example, if you designated an amount to a loved one who passes before you do, you can request that the amount goes to Pi Kappa Phi.

The simplest type of planned gift is made by designating planned gifts by beneficiary designation. These gifts aren’t made in your will. They are made possible by updating the beneficiary on your insurance policy, retirement account or IRA. Simply indicate what percentage of your retirement accounts or insurance policy goes to your loved ones and what percentage goes to the Pi Kappa Phi Foundation.

Retirement Account: You can designate Pi Kappa Phi on all, or on a portion of, a retirement account, such as a 401(k), 403(b), or an Individual Retirement Account (IRA) by contacting the trustee at the company or bank that administers the funds. When you make a designation to Pi Kappa Phi from your retirement account, you retain possession of the total amount of the asset for as long as you need. The remainder is designated to the Pi Kappa Phi Foundation. Consult your accountant, tax adviser or attorney about the comparative advantages of leaving your retirement account funds to the Pi Kappa Phi Foundation.

Insurance Policy: You can designate the Pi Kappa Phi Foundation as a partial or full beneficiary of an insurance policy you no longer need or use. Often, you receive a benefit as well: Pi Kappa Phi receives the cash value of the policy, and you can claim the gift amount as a charitable gift tax deduction.

Qualified Charitable Distribution: Once you turn 70 1/2, you may start withdrawing money out of your IRA. This is known as a Qualified Charitable Distribution. At age 73, you must start withdrawing money out of your IRA. This is known as your Required Minimum Distribution. In either case, federal law allows you to make a direct charitable transfer from your IRA to a qualified charity like the Pi Kappa Phi Foundation. The law allows individuals who are 70 1/2 or older to donate gifts from their IRA accounts in any amount up to $100,000 each tax year. Your gift is not considered income, making it tax free. This applies to IRAs only, not 401(k) or 403(b) accounts.

Donor Advised Funds: Donors can support the Pi Kappa Phi Foundation with contributions directly from individual donor advised funds. You can designate the Pi Kappa Phi as a full or partial beneficiary of any remainder in a donor advised fund upon your (and your spouse’s) passing.

Yes! Gifts of any size are deeply appreciated. Many people choose to leave a percentage of their estate, which scales up or down with your estate size.

Yes! Knowing in advance about your intentions is quite helpful to our staff, but you are always welcome to not share your gift.

We’ve partnered with FreeWill to help you make a will or trust at no cost to you. You can use this to complete your plans, or you may choose to use the same tools to get your affairs in order before visiting an attorney (who is likely to have a fee associated with finalizing your plans).

Yes. You are always free to revise or update your estate plans.

Yes! FreeWill will never share your personal information without your permission.

Make your will today

100% free

Trusted and secure

Done in under 20 minutes

We’re here to help you meet your goals!

Our team would be happy to speak with you in confidence about your giving goals, with no obligation.

Name: Dr. Tom Sullivan

Title :President, Pi Kappa Phi Foundation

Phone: 980-318-5366

Email: tsullivan@pikapp.org

Already included us in your estate plan? Let us know