Make an impact while planning for your future

We also offer the ability to create a free Revocable Living Trust

Everybody needs a will

Whether you’re 18 or 108, everyone should have a will in place. People use wills to choose who gets their property, name guardians for minor children, provide a plan for pets, and more.

Through a will, many people also choose to leave a part of their estate to Pi Kappa Phi Foundation and make an impact on the causes they love, for years to come.

Why give in your will?

Common gifted assets in wills and trusts

- Financial accounts

- Real estate

- Vehicles

- Brokerage accounts

- Crypto and NFTs

- Personal property

Make your will online – for free!

Pi Kappa Phi Foundation has partnered with FreeWill to offer an online estate planning tool that makes it easy and cost-free to make your plan. In as little as 20 minutes, you can help support our mission for future generations.

We also offer the ability to create a free Revocable Living Trust

Popular resources

Sample bequest language

A bequest is one of the easiest gifts to make. With the help of an attorney, you can include language in your will or trust specifying a gift to be made to family, friends or the Pi Kappa Phi Foundation as part of your estate plan. We have provided sample bequest language that may be helpful.

NOTE: This sample bequest language is provided for illustrative purposes only. Requirements for the proper execution of a valid will are determined by state law. Please consult your own legal advisors about your specific situation.

Sample codicil language

A codicil is a legal document that is made to modify an earlier will. A codicil may add or revoke changes to the will, such as gifts. Depending on the state you live in, each codicil may need to conform to the same legal requirements as the original will. With the help of an attorney, you can include language in your will or trust specifying a gift to be made to family, friends or the Pi Kappa Phi Foundation as part of your estate plan. We have provided sample bequest language that may be helpful.

NOTE: This sample bequest language is provided for illustrative purposes only. Requirements for the proper execution of a valid will are determined by state law. Please consult your own legal advisors about your specific situation.

Make your mark with Pi Kappa Phi.

Since 1904, Pi Kappa Phi has prepared generations of young men to lead in their chapters, campuses, and communities. Their impact is the legacy of our Founders: a story of exceptional leadership which has bettered the world around us. Through a planned gift, you can leave a legacy that will advance the story our Founders began. Planned gifts allow you to make a lasting impact on Pi Kappa Phi.

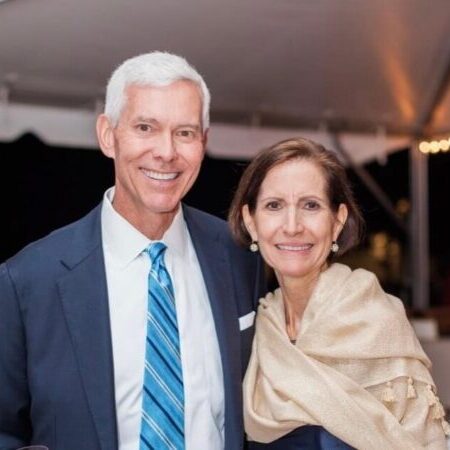

Stuart and Katie Hicks’ story

For a simple reason, Pi Kappa Phi Foundation is an identified beneficiary in my estate plans: I have been the true beneficiary for more than 47 years of membership and affiliation in Pi Kappa Phi and continue to be.

Read moreFrequently Asked Questions

The most common type of planned gift are through written estate plans. These gifts allow you to designate Pi Kappa Phi as a beneficiary of a gift in your will or trust. This is the most common type of planned gift, and it refers to any donation from your will or trust. You are able to make a planned gift to the Foundation through your will or trust simply by naming us as a beneficiary just as you would a loved one.

Gifts can be specified as:

- a specific dollar amount of money.

- a specified number of shares of stocks, bonds or mutual funds.

- a percentage of the value of your estate.

- specific items of value, such as a piece of property, a parcel of land, a vehicle, artwork, and more. (If you designate a gift in this way, please let us know before you finalize your plans to make it easier for the executor of your will and for the Foundation.)

- the “residue” in your estate; that is, the Pi Kappa Phi Foundation receives what remains after your other named priorities and loved ones have been (taken care of/attended to/accounted for) per your wishes.

- a “contingent beneficiary.” For example, if you designated an amount to a loved one who passes before you do, you can request that the amount goes to Pi Kappa Phi.

Yes! Gifts of any size are deeply appreciated. Many people choose to leave a percentage of their estate, which scales up or down with your estate size.

Yes! Knowing in advance about your intentions is quite helpful to our staff, but you are always welcome to not share your gift.

We’ve partnered with FreeWill to help you make a will or trust at no cost to you. You can use this to complete your plans, or you may choose to use the same tools to get your affairs in order before visiting an attorney (who is likely to have a fee associated with finalizing your plans).

Yes. You are always free to revise or update your estate plans.

Yes! FreeWill will never share your personal information without your permission.

We’re here to help you meet your goals!

Our team would be happy to speak with you in confidence about your giving goals, with no obligation.

Name: Dr. Tom Sullivan

Title :President, Pi Kappa Phi Foundation

Phone: 980-318-5366

Email: tsullivan@pikapp.org

Already included us in your estate plan? Let us know

More ways to make an impact

Beneficiary designations

Gifting assets not covered by your will — like 401(k) or IRA accounts — may help your heirs avoid unwanted taxes, even if you’re below the estate tax threshold.

Popular tax-smart gifts

Many people are increasingly choosing to give non-cash assets, so they can have a bigger impact at less cost to them.

Gifts that pay you back

Give assets while providing yourself or others with income for a period of time or distributions at a later date.